One of the most important tasks in setting up Workday® Financial Management is the integrations for automated reconciliation of bank accounts. Fortunately, data ETL (extract, transform, and load) operations are much less painful than they were only a few years ago. We now have standardized methods and protocols, and Workday® provides all the tools you will need in its cloud integration platform.

There are, however, a few things to know when you set up your accounts and integrations.

File Transfer

One of the first things you will want to do is to work with your financial institutions to get the file specifications for the transfer. The standard file format is the international BAI2 standard. That doesn’t mean every bank’s file is identical. Each financial institution will require its own values in the optional fields of a BAI2 file.

The file specification allows the sender to determine whether it is a complete record or only changes or delta. Standard practice is to transmit only delta.

You can get a copy of the BAI2 specification from the Bank Administration Institute, but your financial institution will provide the information you need.

Workday® Reconciliation Setup

Before you can set up reconciliation integrations you will need to create your bank accounts in Workday®. Once you have that done you will use Reconciliation Configuration to set up your reconciliation rules.

Basic Reconciliation

If you do not check the Advanced Mode box in your bank account setup, automatic reconciliation will check transaction amount and reference number for each transaction and reconcile the item if both match. If only one matches, it suggests a match without reconciling.

Advanced Reconciliation

Use Advanced Reconciliation if you want to set up rules to control how items are matched. You can create rules both for partial matches and for first notice items.

The order of rules is important. Set your rules in the order of specificity: the most restrictive rule should be first, and the least restrictive should be last.

Automatic reconciliation performs three actions, and you will want them to be in this order:

- Matches each item in your bank’s file to items in your record.

- Adds items in your record when an item in the bank statement is the first notice, such as bank fees, transaction fees, and wire transfers. You will set up the rules for handling first notice items.

- Suggests items that are a partial match according to rules you set up, or only list them.

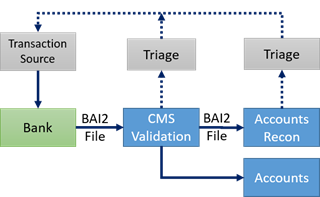

Reconciliation Process

Depending on where transactions originate, the front end of the process will be different. This is the basic flow for the actual reconciliation process.

- Connect to SFTP server and retrieves account file (SOAP/REST).

- File presented to Inbound integration event in the Cash Management System (CSM) for auditing and file validation.

- Integration event will process record by record according to validation rules and send exception notifications.

- CMS sends validated file to Account Reconciliation.

- Reconciliation can be manually started or configured to start automatically.

- Errors should be corrected in the source system to generate a new file with only the records that produced errors.

We hope you find this information helpful. Please join the conversation by submitting your comments and questions in the form below.

Pixentia is a full-service technology company dedicated to helping clients solve business problems, improve the capability of their people, and achieve better results.