When you want to pitch your business case for a new human capital management system, you will need your CFO’s support – and we all know the way to a CFO’s heart is through his budget. To win your campaign, you will need to calculate the total cost of ownership (TCO).

Strategic Alignment

Begin the process with a thorough analysis of your workforce strategy and how it supports the organizational strategy. You will need to determine if workforce changes will impact your technology needs. For example, if you are planning global expansion, you will want to include localization in your TCO model.

List the capabilities your technology must have to support the strategy. List the technology changes required to support the strategy, then outline the desired future state. It will help frame the objectives for your proposed project.

Define Your Objectives

As in any project, setting your objectives at the beginning will keep you focused on your purpose. Some objectives will stand on their own, and some will connect directly to company strategy. Here are some examples:

- Consolidate applications into a single platform

- Support global localization on a single platform

- Convert to a shared services model

- Reduce turnover with onboarding

- Reduce costs and increase employee satisfaction with self-service

Assess the Current State

Before you can evaluate the costs of your current technology, you need to determine what the proposed life cycle will be. The service life of an HCM suite is indefinite, but to make a cost comparison you need a definite time frame. Your company’s asset lifecycle management policy may specify the cycle length. If not, you will need to work with your CFO and CIO to come to an agreement on what it should be.

You can request a cost analysis from your IT department, but it will most likely not include significant items that could be relevant to your proposal.

- If you are planning to move to a self-service model for the first time, the cost analysis should include the labor costs of processing transactions. In a Tech Target article, Sue Hildreth described a case where an HR manager used a stopwatch to calculate time spent on paperwork to update their personal information.

- If you are consolidating applications, include the labor cost of duplicate data entry.

- Include direct and indirect training costs, such as the labor cost of a peer trainer.

- Calculate the labor costs of “workarounds” created to cope with outdated software processes.

Hidden Costs

Consider not only the direct and indirect costs but also hidden costs. Marty Schmidt of Solution Matrix, Ltd. suggests these as a starting point:

1. Acquisition costs 2. Upgrade costs 3. Reconfiguration costs 4. Setup / Deployment costs5. Operating costs 6. Change management 7. Infrastructure support costs 8. Environmental impact costs

9. Insurance costs 10. Security costs 11. Financing costs 12. Disposal costs 13. Depreciation

The Future State

Before you assess the current state, break down your objectives into actionable items. Determine whether you can achieve them with your current technology.

Estimate the costs of the technology changes you need. Many vendors will be delighted to listen to your thoughts and give you pricing guidelines. Most companies will give you references you can call to gather information. You can also get information from industry analysts or independent publishing houses such as Gartner.

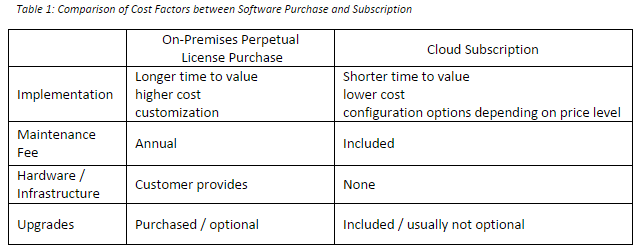

You may be considering a move from on-premises technology to Software as a Service (SaaS). The cost structures are very different, so you will need to be careful to include all relevant costs. For example, a SaaS vendor might say there are no IT costs after implementation, but your IT department may need to support additional internet bandwidth and maintain data feeds between on-premises enterprise applications and your HCM system.

Although there are many ways to deploy software, we can compare the basic differences between on-premises purchased software and cloud SaaS subscriptions in the table below.

The Bottom Line: Cash Flow Analysis

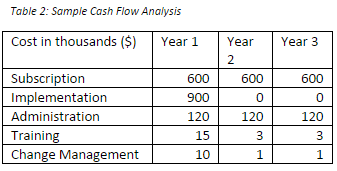

Bring your information together in a cash flow comparison over the lifecycle of the product. Compare the proposed solution to the status quo. TCO does not examine the benefits of the change, but you should include avoided costs and cost savings.

Your CFO or Purchasing can help you with structuring your cash flow analysis. If not, this article by Marty Schmidt may be helpful.

With your completed cash flow analysis as the bedrock of your proposal, you are ready to create your proposal. Before you do, read our [upcoming article] on how to build a business case for human capital management.

Recommended Reading:

Schmidt, Marty. Business Case Essentials, 4th Edition. Solution Matrix Ltd., June 2014.

Leave a Comment